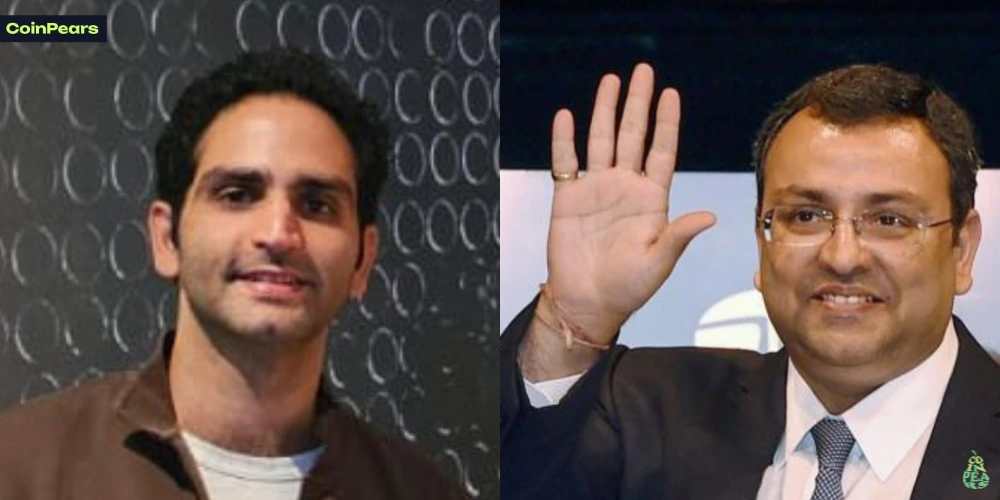

Firoz Mistry is known as the elder son of the late Cyrus Mistry, who served as chairman of Tata Sons.

After Cyrus’s tragic death in 2022, Firoz inherited a significant role in the Mistry business legacy, including stakes in Tata and Shapoorji Pallonji Group.

His name has gained attention in wealth lists, and he is often mentioned among the world’s youngest billionaires.

Who is Firoz Mistry?

Firoz Mistry is one of the two sons of the late Cyrus Mistry, the former chairman of Tata Sons. He and his brother Zahan inherited their father’s share in family holdings after Cyrus Mistry’s death in 2022.

Firooz (often written as Firoz in media coverage) is a member of the next generation in the Shapoorji Pallonji (SP) Group and related family businesses.

Public profiles list Firoz among young heirs who suddenly became important shareholders and board members as the family reorganized ownership and management following Cyrus Mistry’s passing.

Public profiles list Firoz among young heirs who suddenly became important shareholders and board members as the family reorganized ownership and management following Cyrus Mistry’s passing.

Major business press has followed his appointments to group holding companies and mentions him when covering family strategy.

Early Life & Education

Firoz Mistry was born into a family already rooted in India’s industrial and business circles. His father, Cyrus Mistry, was a prominent business figure tied to both Tata and the family’s own Shapoorji Pallonji interests.

Because Firoz and his brother Zahan grew up in this environment, they were exposed early to corporate affairs, inheritance structures, and governance.

In terms of education, media sources state that Firoz studied at the University of Warwick. This indicates he received international education, which is common among heirs of major business families who combine local influence with global exposure.

Mistry and Business Heritage

The Mistry family’s wealth and business influence stem largely from the Shapoorji Pallonji Group (SP Group) and a large stake in Tata Sons.

SP Group is a major Indian conglomerate working in construction, infrastructure, real estate, energy, water, and related sectors. It is publicly known that the group’s ownership includes shares held by Mistry family members.

Cyrus Mistry, Firoz’s father, inherited the SP legacy and a substantial shareholding in Tata Sons reportedly 18.4% via family companies and holdings. After Cyrus’s passing, those stakes were passed, in part, to Firoz and his brother Zahan.

Thus, Firoz Mistry is not starting from zero. His wealth and potential influence are tied to inherited assets.

At present, media reports indicate that Firoz holds shares of interest in both Tata Sons and stakes in the SP Group. Unfortunately, public filings that show exactly how many shares remain in his name are limited.

Net Worth & Inheritance

One of the biggest public talking points around Firoz Mistry is his net worth. According to Forbes, Firoz is estimated to have a net worth of $4 billion, largely derived from his inherited share in Tata Sons and other holdings.

Various media outlets also mention that Firoz and his brother Zahan together inherited assets worth $9.8 billion, implying that each has around $4.9 billion.

Another source, Grizzly Bulls, lists his real-time net worth closer to $3.53 billion as of late 2025.

Because much of this value is in large holdings (private or public), the valuation can vary significantly depending on share price, debt loads, and corporate moves.

Role & Business Activity

Firoz’s public involvement in business has increased recently. Notably, he has been appointed to the board of Afcons Infrastructure, a core part of the SP Group’s construction arm.

This role marks one of his first operational board positions, indicating that he is beginning to take direct oversight responsibilities in the family business empire.

This role marks one of his first operational board positions, indicating that he is beginning to take direct oversight responsibilities in the family business empire.

Given his educational background, inheritance, and the scale of his holdings, many see Firoz as entering a phase of transition—from heir to active manager.

Why Firoz Mistry matters to markets

Firoz matters for three main reasons. First, he is a direct heir to shareholdings that have influence over Tata Sons, a conglomerate with major listed companies.

Second, his board roles in SP Group entities place him in a position to affect strategy and capital decisions. Third, media visibility around the next generation can shape investor expectations about future listings or asset sales.

When family members of large shareholders become active, markets and analysts pay attention because such moves sometimes lead to clearer strategies, partial listings, or consolidation of assets events that can unlock value in the medium to long term.

However, these developments are not guaranteed and depend on execution and market conditions.

Read Also: Rohiqa Chagla Life, Wealth & Biography

Public perception and media coverage

News outlets have given significant coverage to Firoz and his brother as part of a generational shift in the family’s business management.

Coverage often focuses on wealth rankings, board appointments, and family strategy. Profiles tend to be factual and refrain from speculation about private matters.

Major reports emphasize that while the brothers are young, they now hold important roles and will influence the family’s next steps.

It is worth noting that public interest tends to spike around high-profile events such as appointments, listings, or legal disputes.

Outside of these events, the brothers maintain a lower public profile, reflecting a common pattern among wealthy business families who prefer privacy.

Challenges & Risks

While Firoz’s position seems strong, the path forward is not without complications.

Valuation uncertainty: Much of his net worth exists in shareholdings that fluctuate with markets and corporate decisions.

Debt and liabilities: The SP Group and related entities often carry significant debt obligations, which the heirs may have to manage or refinance.

Public scrutiny: As one of the younger billionaires, he faces intense media attention and expectations.

Generational shift: Moving from inheritor to decision-maker is a challenge—he must develop leadership skills, manage conflicts, and gain stakeholder trust.

Regulation and corporate governance: Holding stakes in big conglomerates means dealing with regulators, minority shareholders, and legal frameworks.

Final Thoughts

Looking ahead, Firoz Mistry has significant potential. His net worth could grow if Tata Sons shares increase in value or if SP Group businesses expand. His early board role in Afcons suggests he may be more active in driving growth within core assets.

However, his success will depend heavily on how well he navigates debt, corporate strategy, and investor confidence. Many will watch whether he transitions from simply inheriting wealth to shaping it.

Buy XRP with EUR - Best Crypto Buying Rates

Frequently Asked Questions (FAQ)

Who is Firoz Mistry?

Firoz Mistry is the elder son of Cyrus Mistry. He inherited significant family holdings in Tata Sons and the Shapoorji Pallonji group.

What is Firoz Mistry’s net worth?

Media sources commonly report his net worth as $4 billion. Other estimates vary (e.g. $3.53B).

How did Firoz Mistry inherit his wealth?

He inherited his share of family assets after his father’s death, including part of Tata Sons stake and interests in SP Group.

What is his role in business now?

He has recently joined the Afcons board, indicating active involvement in the SP Group’s operations.

Is Firoz Mistry among the world’s youngest billionaires?

Yes, he is often listed among the youngest billionaires under 30. His wealth ranks among top young heirs globally.