Inpixon (ticker: INPX) is a U.S.-based small-cap company working in indoor intelligence technology. The firm develops sensors, mapping software, and analytics that help organizations better manage spaces like offices, hospitals, and shopping centers.

For years, INPX stock has traded at penny-stock levels, attracting both speculative investors and those curious about whether a turnaround could happen.

What Is Inpixon (INPX)?

Inpixon is a company that works in indoor positioning, sensor technology, and data analytics. Its technology focuses on collecting location-based signals indoors (via WiFi, Bluetooth, sensors) and turning that into useful information for facilities, retail, security, and enterprise clients.

Because of its tech focus, INPX is often treated as a speculative stock. The value of its share price depends heavily on future adoption of its technology, revenue growth, and execution.

How Forecasters Build An INPX Stock Forecast

Different sites use different methods. Here are the main approaches you’ll see:

Technical models use price charts, moving averages, and momentum indicators to predict short-term moves (used by forecasting tools that give daily or monthly targets).

Algorithmic / AI forecasts try to fit patterns in historical price and volume data to produce multi-year curves (used by some automated sites).

Fundamental analysis looks at revenue, earnings, cash, debt, and business prospects. For INPX, revenues and earnings have been small relative to enterprise costs, so fundamentals often point to a speculative view unless the company improves margins or wins steady contracts.

Each method can produce a plausible number, but none is a guarantee — especially for microcap tickers like INPX where a single press release or small trade can change the price.

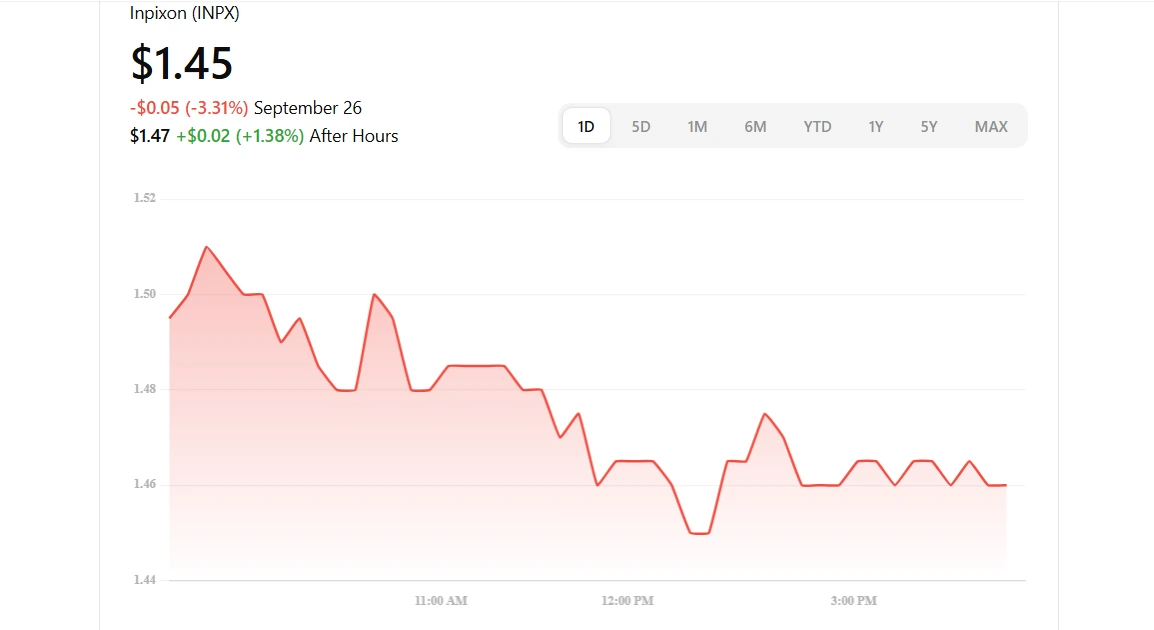

INPX Recent Price

Before looking at future predictions, it’s useful to check the current price trends of INPX. Over the past few years, the stock has traded at very low values. For example, in mid-2024, it recorded a closing price of just $0.0527. This shows how volatile and risky the stock has been.

Before looking at future predictions, it’s useful to check the current price trends of INPX. Over the past few years, the stock has traded at very low values. For example, in mid-2024, it recorded a closing price of just $0.0527. This shows how volatile and risky the stock has been.

From a technical perspective, indicators like moving averages and momentum signals present a mixed picture. The 5-day and 20-day averages are currently higher than some longer-term averages, but the broader trend over time remains negative.

When it comes to analyst ratings, there is not a lot of coverage on INPX. Available data shows that only about 43% of analysts give it a “Buy” rating, which suggests a moderate and cautious sentiment.

Some forecasting platforms show very optimistic long-term targets. For instance, WalletInvestor projects that INPX could reach as high as $14.904 per share in five years. However, such numbers are highly speculative and should not be taken as guaranteed outcomes.

Overall, these signals highlight the stock’s uncertain nature. While the potential upside looks impressive on paper, the risks and volatility remain extremely high, so investors should approach with caution.

INPX Stock Forecasts 2025

Let’s review some of the prominent forecasts and see how realistic they are.

Forecast Source | Time Horizon | Predicted Price | Notes / Caution |

|---|---|---|---|

CoinCodex | Aug 2025 | ~$0.052701 | Little growth in short term. |

WalletInvestor | 5 years | ~$14.904 | Very high growth assumed; high risk |

Macroaxis | Short term / 90 days | “Not Rated” | Caution, not strongly bullish |

StockInvest.us | Ongoing | ~$0.0527 | Stable baseline assumption |

My View & Reasoned Forecasts

Given current fundamentals and risks, here is a more moderate forecast:

Short-term (6–12 months): INPX may remain in a range between $0.04 and $0.08, unless there is a major catalyst (new contracts, tech adoption, or positive earnings)

Mid-term (2–3 years): If Inpixon can grow revenues and win clients, price might climb to $0.20 to $1.00 — but that is optimistic and would require strong execution

Long-term upside: The extreme forecasts like $10+ or $14.90 rely on huge growth and adoption, which is not assured

So, a high growth forecast is possible but very speculative. Expect wide variance in outcomes.

Read Also: XRP Price Prediction After Lawsuit, What Happens Next?

What Drives INPX Forecasts

To understand the forecast numbers, you should know what factors can push INPX price up or down.

Positive Drivers

New contracts & client wins. If Inpixon lands contracts with large institutions (retail chains, hospitals, malls), revenue can surge.

Technology adoption & scaling. Widespread use of indoor positioning and analytics would increase demand.

Partnerships & integrations. Working with big tech or sensor platforms could expand their reach.

Improved financials. Profitability, cash flow, reduced losses—all matter.

Positive investor sentiment / coverage. More analyst coverage and positive reports can attract capital flow.

Risks & Negative Factors

Low or no revenue growth. If adoption is slow, the stock may languish.

Dilution risk. Issuing new shares to fund operations can dilute existing holders.

Competition. Other players in indoor analytics or IoT may erode Inpixon’s position.

Execution / management risk. Failing to deliver prototypes or products on schedule can hurt.

Regulatory or privacy concerns. Indoor positioning involves data and location information which may face scrutiny.

Buy BTC with EUR - Best Crypto Buying Rates

INPX Stock Forecast 2030

Looking ahead to inpx stock forecast 2030, investors should understand that predictions this far out are highly uncertain. Still, based on current trading patterns, historical pricing, and typical small-cap stock behavior, we can outline some possible scenarios.

In a cautious case, INPX could remain under pressure and trade in the $0.01 to $0.02 range, especially if the company struggles with revenue growth or dilution of shares continues.

In a moderate case, assuming the business achieves steady contracts, improved balance sheets, and stronger adoption, the stock might reach $0.02 to $0.04 by 2030.

In a bullish case, if INPX manages to expand significantly, secure strong partnerships, and build consistent revenue streams, the price could move toward the higher side of $0.04 to $0.05 by 2030.

These estimates show both the potential and the risks. Investors should treat 2030 forecasts as possibilities, not guarantees, and follow company updates closely to adjust expectations.

What to Watch in INPX Stock

If you are following the INPX stock forecast, it’s important to look beyond just predictions and focus on real performance indicators. One of the most important signals is quarterly revenue growth and any new client announcements, since these show whether the company is gaining business traction.

If you are following the INPX stock forecast, it’s important to look beyond just predictions and focus on real performance indicators. One of the most important signals is quarterly revenue growth and any new client announcements, since these show whether the company is gaining business traction.

You should also track gross margins and operating results, as they reveal if INPX is moving closer to profitability or still facing large losses. Another key factor is the number of outstanding shares. If the company issues too many new shares, it can cause dilution and reduce the value of existing holdings.

Investor behavior can also provide signals. Insider buying or selling often reflects how company leaders feel about future performance. At the same time, watch for new partnerships or product launches, as these can create growth opportunities.

Lastly, pay attention to analyst upgrades or new coverage, since these events can influence market sentiment and bring more attention to the stock. Overall, these real-world signals are often more reliable than speculative forecast numbers alone.

How to Use INPX Forecast Info

When looking at any INPX stock forecast, it is important to remember that predictions are not guarantees. Forecasts only show possible scenarios based on current market trends, technical signals, and assumptions about the company’s future.

The best way to use forecasts is to treat them as scenarios rather than assured outcomes. They can help you think about potential risks and rewards but should never be the only reason you invest.

Always check the company’s financial reports, revenue growth, contracts, and market news before making a decision.

It’s also smart to be cautious with extreme predictions. Some forecasts show very high price targets, but these depend on optimistic assumptions. If you don’t fully understand those assumptions, avoid chasing such numbers.

Finally, manage your investments carefully. Consider setting stop-loss orders and only invest a small portion of your capital in highly speculative stocks like INPX. This way, even if the stock does not perform as expected, you can protect most of your money.

Read Also: IonQ Stock Price Prediction 2030

Possible Forecast Scenarios

Let’s imagine three plausible scenarios:

1. Base Case (Moderate Growth)

INPX reaches $0.10 to $0.25 over a few years

Steady client additions and gradual adoption

No extreme dilution

2. Bull Case (Optimistic Growth)

INPX climbs to $1 to $5 if Inpixon becomes a major player in indoor data

Large contracts, tech wins, good margins

Investor excitement & momentum

3. Bear / Base Risk Case

INPX stays sub-dollar

Flat revenues, competitive losses, share dilution

Stock remains volatile with downwards bias

These are not predictions but frameworks to think in.

Final Thoughts

When looking at the INPX stock forecast, it’s clear that the stock carries both potential upside and significant risk. Different analysts and platforms present very different views.

Some forecasts suggest only flat or limited movement, while others are extremely bullish, showing possible multi-dollar price targets.

It’s important to remember that forecasts should be used as guidelines, not guarantees. Stock predictions are based on assumptions that can quickly change with market conditions.

Investors should also keep an eye on the company’s real business progress, such as contracts, revenue growth, and how well management executes its plans. These factors matter more than any chart or prediction.

Finally, always stay cautious of hype. With a highly volatile stock like INPX, it’s wise to never invest more than you can afford to lose. Managing risk is just as important as spotting opportunities.

Frequently Asked Questions (FAQ)

Is the INPX stock forecast realistic?

Some forecasts are very optimistic and built on perfect execution. It’s best to treat them as possible scenarios, not guaranteed paths.

What is INPX’s current valuation?

INPX’s share price is very low (penny stock scale). Its valuation depends heavily on future growth, so present value is modest.

Can INPX reach $10 or more per share?

In theory yes (as some forecasts suggest), but it would require exceptional growth, very favorable conditions, and successful execution.

Is INPX a safe investment based on forecasts?

No. It’s speculative. Forecasts may help guide decisions, but risk is high.