TUFT Token Price Prediction is a topic gaining attention among crypto users who follow emerging blockchain projects and utility-based tokens. As with most digital assets, interest in TUFT comes from a mix of market speculation, project fundamentals, and broader sentiment in the crypto ecosystem.

Understanding TUFT Token Price Prediction requires looking beyond short-term price movements and focusing on factors such as token utility, supply structure, adoption, and overall market conditions.

This article provides a detailed and balanced overview of TUFT Token Price Prediction using available information, realistic assumptions, and risk-aware analysis. It does not promote guaranteed outcomes or financial advice.

Instead, it explains what influences TUFT’s price behavior and how future scenarios may develop.

TUFT Token

Before discussing TUFT Token Price Prediction, it is important to understand what the TUFT token represents. TUFT is designed as a blockchain-based digital asset that supports a broader ecosystem.

Like many modern tokens, its value is tied not only to market demand but also to how effectively it is used within its platform. TUFT typically serves one or more roles, such as facilitating transactions, enabling access to services, supporting governance, or incentivizing participation.

These functions play a direct role in shaping TUFT Token Price Prediction because tokens with real usage often show stronger price stability than those driven purely by speculation.

The long-term outlook for TUFT Token Price Prediction depends on whether the project behind the token continues to develop, attract users, and maintain transparency.

Market Position

TUFT Token Price Prediction is also influenced by where the token sits within the broader crypto market. Smaller or newer tokens often experience higher volatility compared to established assets like Bitcoin or Ethereum. This volatility can lead to rapid price increases but also sharp corrections.

Market position depends on factors such as trading volume, liquidity, exchange availability, and community engagement. TUFT tokens with limited exchange listings may experience lower liquidity, which can amplify price swings. As a result, TUFT Token Price Prediction should always be viewed in context rather than isolation.

Another factor affecting TUFT Token Price Prediction is competition. If TUFT operates in a crowded sector, such as DeFi, NFTs, or infrastructure tools, it must demonstrate clear differentiation to sustain long-term demand.

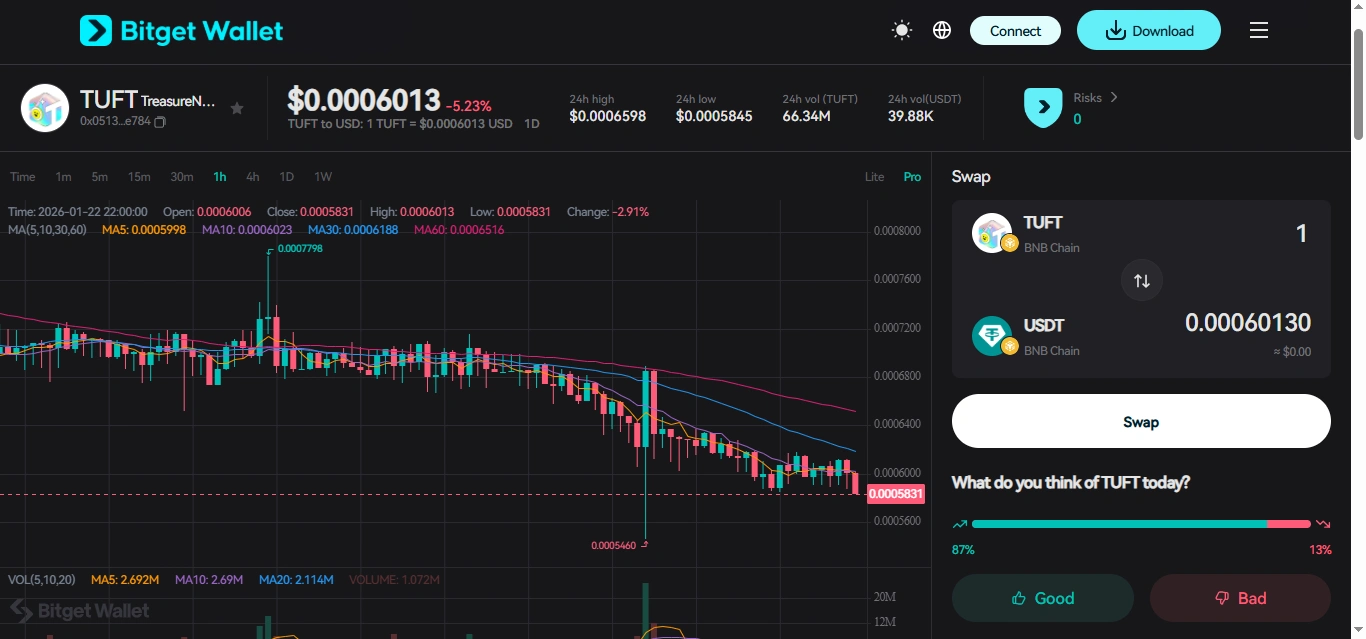

Price Behavior and Trends

Analyzing past performance is a common step in TUFT Token Price Prediction, although historical data alone cannot predict future outcomes. Past price movements can reveal how the token reacts to broader market trends, news events, and shifts in investor sentiment.

If TUFT has experienced periods of rapid growth followed by consolidation, this may indicate speculative interest rather than organic adoption. On the other hand, steady price movement combined with increasing usage may suggest stronger fundamentals.

Historical trends also help identify key support and resistance levels, which traders often reference when forming short-term TUFT Token Price Prediction scenarios. However, these technical patterns are always influenced by external factors beyond the token itself.

Price Influencing Factors

TUFT Token Price Prediction is shaped by a combination of internal and external influences. Internal factors relate to the project’s development, while external factors come from the broader crypto environment.

Internal influences include platform updates, roadmap progress, partnerships, and user growth. If the TUFT ecosystem expands in a meaningful way, demand for the token may increase. Conversely, delays or lack of transparency may negatively affect confidence.

External influences include overall market cycles, regulatory developments, macroeconomic trends, and sentiment toward digital assets. Even strong projects can see declining prices during market downturns, which is why TUFT Token Price Prediction should always consider market context.

Forecasting

Forecasting

When discussing TUFT Token Price Prediction, it’s important to emphasize that forecasts are not guarantees. Instead, they represent ranges based on market expectations, utility rollout, exchange listings, and ecosystem adoption.

Price forecasts for emerging tokens like TUFT vary widely among analysts, largely because of volatility, liquidity, and project developments.

Short-Term Estimate

Early projections for TUFT suggest that the token could trade within a modest range shortly after launch or during 2025, assuming liquidity improves and key platform features go live. Many analysts look at comparable challengers in the NFT and utility token space to form these estimates.

Some forecasting models, based on adoption, exchange listings, and initial staking functions, place the short-term price range around:

$0.01 – $0.03 in early to mid-2025 if core features are operational and trading activity grows.

An initial post-launch range between approximately $0.08 and $0.15 if broader market interest and Tier-1 exchange listings occur.

These ranges reflect the token’s early discovery phase, where speculative interest and initial utility deployment influence price more than long-term adoption.

Mid-Term Projection

For late 2025, several sources project a broader range as ecosystem features mature and circulation patterns stabilize. If key elements such as governance tools, creator monetization features, and staking rewards are widely used, some analysts believe TUFT might approach:

$0.25 – $0.40 by the end of 2025

This mid-term outlook assumes increased utility within the NFT marketplace and enhanced token demand from on-chain activity rather than pure speculation.

These ranges are not guarantees but serve as reasonable frameworks based on observed price behavior of similar tokens and expected functional rolls.

Long-Term Outlook

Beyond 2025, TUFT Token Price Prediction becomes more dependent on sustained adoption, ecosystem expansion, and broader market conditions. In optimistic scenarios where TUFT gains significant utility and liquidity, analysts forecast:

$0.60 – $1.00+ by 2026 or later

This long-term range reflects the potential for the token to attract more users, integrate with NFT and decentralized applications, and benefit from deeper exchange listings.

It’s worth noting that reaching higher valuation brackets like $0.60 or $1.00 requires strong execution, growing demand, and stable or bullish crypto markets.

Quantitative Example

To provide context, consider a hypothetical investor holding 10,000 TUFT tokens under different forecast scenarios:

At $0.01, the holdings would be worth $100

At $0.25, they would be worth $2,500

At $0.60, they would be worth $6,000

At $1.00, they would be worth $10,000

These examples are illustrative and not investment recommendations. They simply show how forecast ranges translate into potential valuations if price ranges were realized.

Forecast Influencing Factors

Several elements could affect where TUFT ultimately trades within or beyond these ranges:

Utility Adoption

Greater use of TUFT for payments, staking, DAO governance, or NFT trading could support stronger demand and higher price confidence.

Exchange Listings

Listings on well-known centralized exchanges often provide more liquidity and broader access, which in turn may affect price discovery.

Liquidity

Low liquidity, as reported on decentralized pools, can distort short-term movement and increase price swings, thereby impacting forecasting reliability.

Market Sentiment

Overall crypto market cycles — bear or bull — play a major role in how any token’s price evolves. Positive sentiment typically expands ranges, while negative conditions compress them.

Roadmap Execution:

Successful platform upgrades, partnerships, and community engagement often correlate with positive price movement.

Risks

Every price prediction carries risk, and TUFT Token Price Prediction is no exception. Market volatility, limited liquidity, and competition are ongoing challenges for many tokens.

Regulatory uncertainty is another risk factor. Changes in crypto regulations can affect exchange listings, user access, and overall market sentiment, which may influence TUFT Token Price Prediction unexpectedly.

Project-specific risks include development delays, security issues, or reduced community engagement. Investors and users should consider these factors carefully when evaluating TUFT Token Price Prediction.

Market Sentiment

Community activity can influence TUFT Token Price Prediction, especially for smaller tokens. Social media discussions, developer engagement, and transparency updates often shape perception.

Positive sentiment may attract new participants, while negative sentiment can spread quickly and impact price. However, sentiment alone is not a reliable indicator of long-term value, which is why TUFT Token Price Prediction should always be grounded in fundamentals.

A strong and informed community often supports healthier price behavior by encouraging responsible participation rather than speculation.

Comparison With Similar Tokens

Comparative analysis is sometimes used in TUFT Token Price Prediction to understand relative valuation. Comparing TUFT to tokens with similar use cases can highlight strengths or weaknesses.

However, comparisons should be made carefully. Differences in token supply, adoption stage, and market exposure can lead to misleading conclusions. TUFT Token Price Prediction should be based on its own metrics rather than direct price matching.

This approach helps maintain realistic expectations and reduces reliance on speculative benchmarks.

Also Read: Tradytics: A Detailed Educational Guide

Regulatory Considerations

Regulatory developments increasingly influence TUFT Token Price Prediction. Compliance requirements, exchange policies, and jurisdictional rules can affect accessibility and liquidity.

Projects that prioritize transparency and regulatory awareness may face fewer disruptions over time. While regulation can create short-term uncertainty, it may also contribute to long-term stability if handled responsibly.

TUFT Token Price Prediction should account for potential regulatory changes without assuming either extreme outcomes.

Frequently Asked Questions

What is TUFT Token Price Prediction based on?

TUFT Token Price Prediction is based on market trends, token utility, supply structure, adoption, and broader crypto conditions.

Is TUFT Token Price Prediction guaranteed?

No, TUFT Token Price Prediction is speculative and does not guarantee future price performance.

Can TUFT token increase in value?

TUFT’s value may change depending on adoption, market sentiment, and project development, but outcomes are uncertain.

Is TUFT suitable for long-term holding?

This depends on individual risk tolerance and belief in the project’s long-term utility and development.

Does market volatility affect TUFT Token Price Prediction?

Yes, overall crypto market volatility can significantly impact TUFT Token Price Prediction.

Conclusion

TUFT Token Price Prediction involves analyzing a combination of market data, project fundamentals, and external conditions. While the token may benefit from increased adoption and ecosystem growth, it is also subject to volatility, competition, and regulatory uncertainty.

This article has presented TUFT Token Price Prediction in a balanced and realistic way, without hype or guarantees. Anyone interested in TUFT should focus on understanding the project’s utility, monitoring development progress, and staying informed about broader market trends.

As with all digital assets, TUFT Token Price Prediction should be approached carefully, with awareness of both potential opportunities and risks.